by Scott Buchanan | Aug 5, 2020 | Letters to Congress

SLSA recently submitted to Congressional leadership, the Department of Education, and the CFPB these several recommendations of legislative or regulatory changes and flexibilities surrounding Federal Loan Repayment.

by Scott Buchanan | Aug 4, 2020 | Other Information

This video explains what student loan servicers do to help students succeed in paying for post-secondary education and in repaying their student loans.

by Scott Buchanan | Jul 30, 2020 | Press Releases

The membership of the Student Loan Servicing Alliance has elected its Leadership and Board of Directors for 2020-2021, effective August 1, 2020.

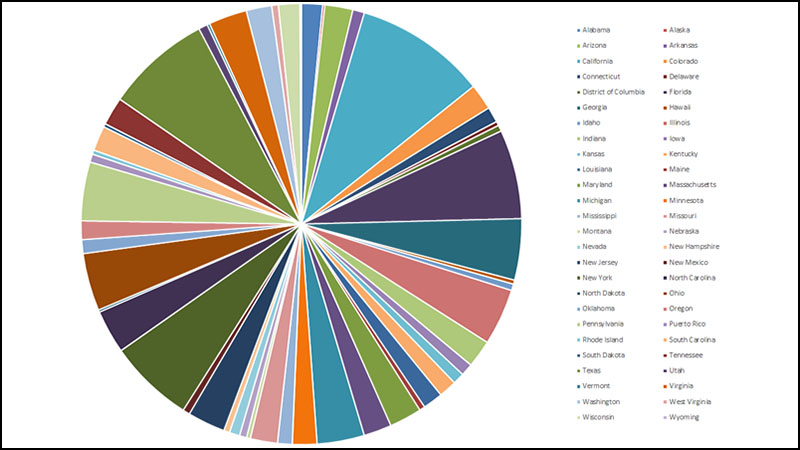

by Scott Buchanan | Jul 23, 2020 | Other Information

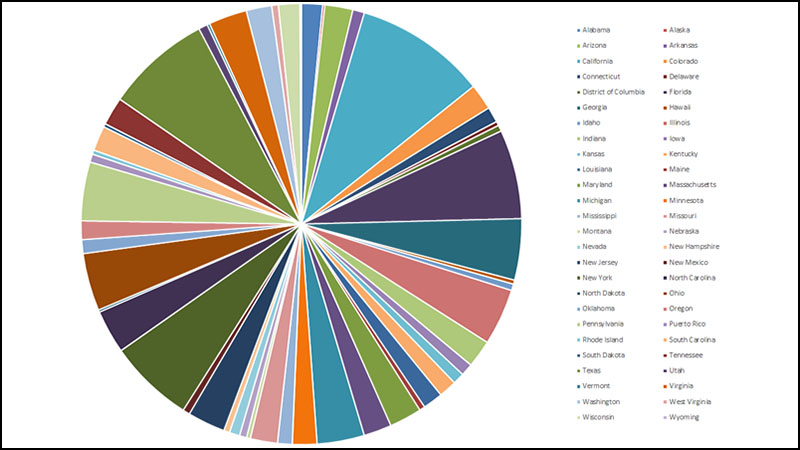

Outstanding dollars and number of borrowers included in Federal Student Loan Portfolios by State and projected commercially held FFEL Program Loans by State.

by Scott Buchanan | Jul 16, 2020 | Op Ed

CFPB complaint data for the past several years has shown continued student loan industry success as complaints by borrowers have decreased by more than 30%…

by Scott Buchanan | May 11, 2020 | Press Releases

SLSA members continue to offer flexibility on private student loans in every state due to the coronavirus pandemic.

by Scott Buchanan | Apr 13, 2020 | Letters to Congress

CARES Act Relief Excludes As Many As 9 Million FFELP and Perkins BorrowersSLSA and more than 20 other organizations reflecting a broad set of viewpoints all support Congress taking steps to ensure that federal student loan borrowers are provided interest subsidy...

by Scott Buchanan | Mar 31, 2020 | Press Releases

SLSA has been working with its members to share private education loan payment flexibility info to all borrowers (who request it) impacted by the coronavirus.

by Scott Buchanan | Mar 5, 2020 | Legal Proceedings

The Student Loan Servicing Alliance has filed an amicus brief in Barr v. American Association of Political Consultants.

by Scott Buchanan | Dec 5, 2019 | Press Releases

The Student Loan Servicing Alliance (SLSA) supports the bipartisan agreement passed in the Senate today to amend the FUTURE Act.