SLSA Members Elect 2019-2020 Board

New leadership and the 2019-2020 Board will continue to lead our efforts in the next year to work with all stakeholders on issues related to student loan servicing.

New leadership and the 2019-2020 Board will continue to lead our efforts in the next year to work with all stakeholders on issues related to student loan servicing.

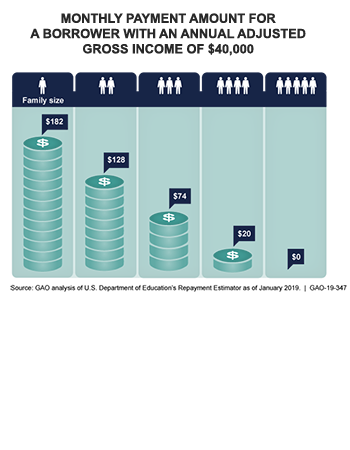

On July 25, 2019, SLSA issued a statement in response to the GAO report on IDR information verification (GAO-19-347) that outlined areas for improvement in order to reduce fraud and errors. Servicers have been actively promoting legislation and processes to do just that over the past few years by curbing companies that are committing fraud and also encouraging data-sharing between ED and Treasury.

Servicers have a unique role to play in the federal student loan program as the government’s loan program has grown over time.

This fact sheet gives a high level overview of who servicers are, and their success in driving utilization of income-based repayment plans.

On November 21,2018, U.S. District Court for the District of Columbia Judge Paul Friedman issued a ruling in Student Loan Servicing Alliance (SLSA) v. Taylor, finding that the District of Columbia may not regulate those student loan servicers under contract with the U.S. Department of Education to service Federal Direct Loans and federally-owned Federal Family Education Loan Program (FFELP) loans.

In his 70-page opinion, Judge Friedman comprehensively addressed the Supremacy Clause issues of express, field, and conflict preemption, as well as intergovernmental immunity.

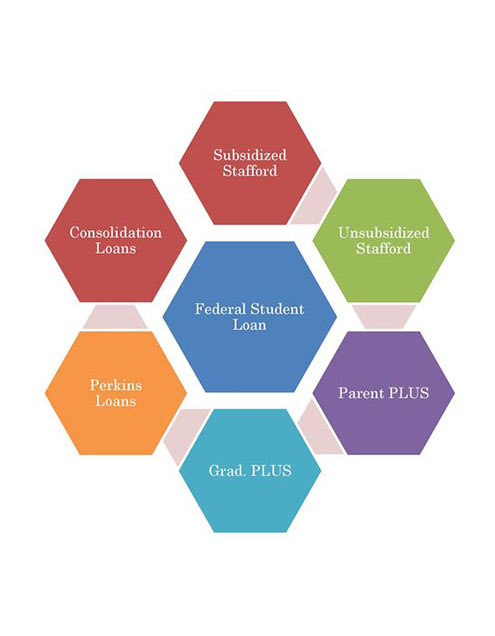

Primer on the Types of Federal Student Loans

Confused about which type of federal student loan you have? This primer will help you figure it out, including the loan repayment plans that loans in each program are eligible for.

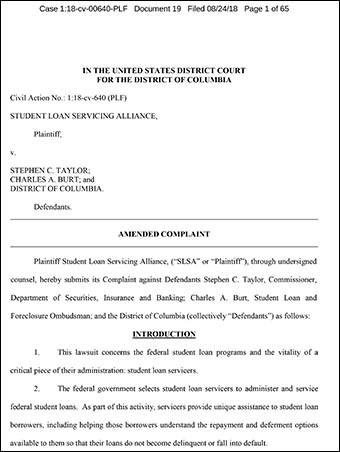

Amended Complaint – civil action filed in the United States District Court for the District of Columbia by the Student Loan Servicing Alliance (SLSA) challenging District of Columbia Law 21-214 and emergency rules to impose additional requirements and fees on federal student loan servicers beyond what is prescribed by federal law.

Federal law establishes the precedent for the federal Department of Education’s (ED) management and oversight of the federal student loan programs, and federal preemption of any conflicting regulations at the state level.

Trade group sues District of Columbia to prevent student loan borrower confusion. Lawsuit challenges local law imposing regulations preempted by federal law.

March 20, 2018, the Student Loan Servicing Alliance (SLSA) filed a civil action in the United States District Court for the District of Columbia challenging District of Columbia Law 21-214 and emergency rules to impose additional requirements and fees on federal student loan servicers beyond what is prescribed by federal law. The lawsuit was filed on the grounds that federal law preempts D.C. Law 21-214 and the emergency rules.

The vast majority of borrowers are managing their student loans successfully. Student loan servicers are on the front lines helping. Check out our Fact Sheet to learn more.

![]() Download

Download

Testimony of Winfield Crigler, Executive Director SLSA

Before the Joint Consumer Protection and

Professional Licensure Committee July 18, 2017.

Some very brief background on the student loan programs:

• SLSA opposes S129 and H2173

• Federal Loans are already extensively regulated.

• Most federal loan borrowers are successfully repaying their student loans.

• The current Department of Education compensation structure encourages servicers to do the right thing.